Bitcoin was the original cryptocurrency invented in 2008 by parties unknown; whomever it is using the name Satoshi Nakamoto.

While blockchain is the underlying technology Satoshi Nakamoto used to create Bitcoin, the technology itself was actually invented in 1991 by Stuart Haber and W. Scott Stornetta. Their first work involved working on a cryptographically secured chain of blocks, ensuring the integrity of digital records, whereby no one could tamper with the timestamps of the documents. But it was only in 2008 that the first application of Blockchain technology came into being with Bitcoin. The vision at the time – just after the financial industry meltdown in 2008 – was to provide an alternative currency free of bank or government manipulation.

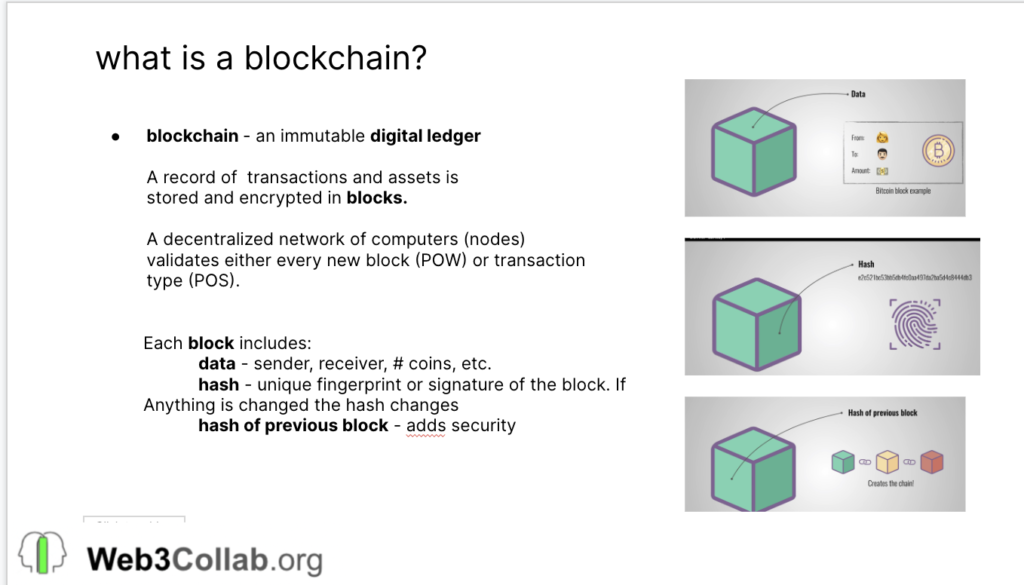

It was built on Blockchain technology, a distributed database whose key innovation is to guarantee the fidelity and security of a record of data and generate trust without the need for a trusted third party.

Hence the term “trustless” transactions.

Bitcoin did this by structuring data in blocks, which are filled, closed, and linked to the previous block in a permanent ongoing chain using cryptology. Every transaction is confirmed and added to the chain only after some type of confirmation that the transaction is valid by a decentralized (or at least semi-decentralized) network of other computers, and given a time stamp. The importance of this structure is that when implemented in a decentralized manner, it creates an irreversible timeline. The combination of chronological order and a decentralized network means that the data is irreversible and transactions are permanently recorded, and viewable by anyone. Thus, no central authority or middleman – such as a bank – is required.

Keep in mind that this is the structure of an idealized crypto economy; however there are numerous exceptions to the flawless chains of transactions envisioned, including the ever-morphing “proof” or consensus around the transactions and large entities holding such a large share of the consensus computers or requirements so that decentralization is an overstatement, among other risks; but a cryptology-secured, decentralized mechanism of transacting is at the core of the value-proposition for blockchain creators.

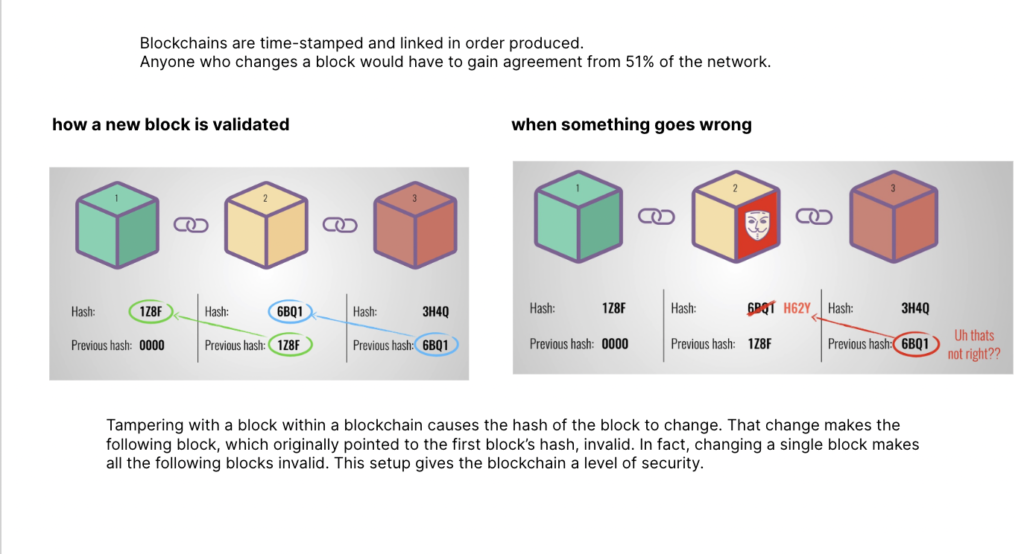

To understand further how this works, another aspect of blockchains is that each block has a unique signature, called a hash, plus the unique signature of the previous block. As the blocks are validated by the decentralized network of computers all over the world, if any computer spots an error in the signature from any block anywhere on the chain, the transaction is invalid.

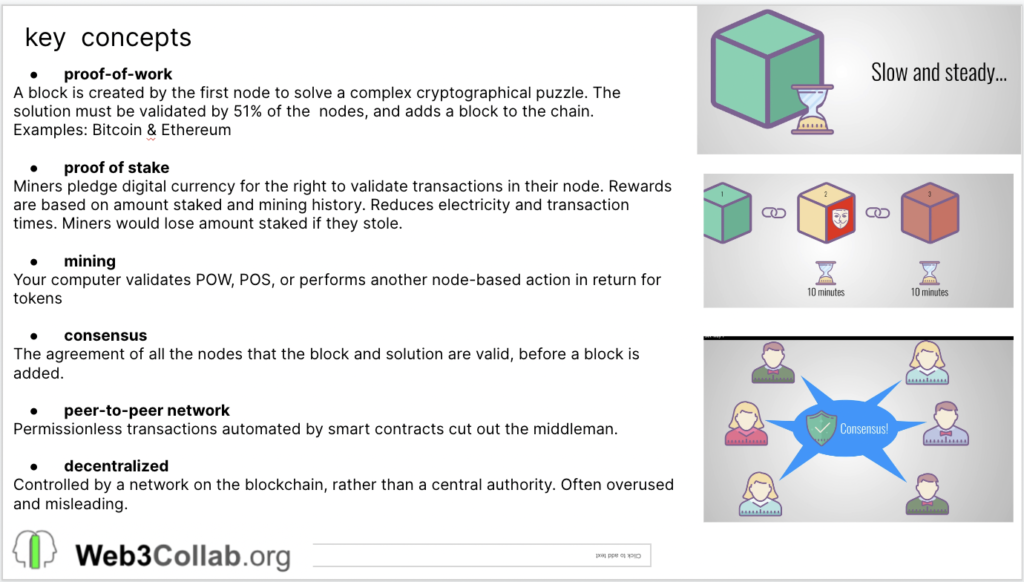

The two fundamental ways blocks can be validated are by Proof of Work (POW) which Bitcoin still uses, or Proof of Stake (POS). Proof of work (POW) is notoriously time and energy-consuming, and the owners of these massive supercomputers are rewarded by earning Bitcoin for each transaction. They compete to earn this reward by solving a highly complex mathematical puzzle, about one every ten minutes. The computer with the right answer is awarded a piece of a Bitcoin, and the answer is saved as the hash. All the computers in the network confirm that hash so that in order to make a change, 51% would have to agree. This makes it highly secure, even though there is no bank or government backing involved. Bitcoin has never been hacked, although other chains have. While Proof of Word is slow and expensive, it is considered more secure and decentralized than Proof of Stake.

In the Proof of Stake model, the agreement or consensus is arrived via a different method. Investors become validators by staking a required ammount of the native token of a particular blockchain. Selected at random these validators then and earn – or mine – additional rewards in that token simply for holding, or staking, it.

]

Bitcoin is still the highest-valued cryptocurrency in the market, with a meteoric rise and stamp of approval from JP Morgan, thousands of Bitcoin ATMs slated for installation in Walmart stores, and early adoption by Square. Prices increased from $20,000 to $60,000 from 2020 to 2021, and sank to about $16,000 again by the end of 2022, demonstrating the significant volatility of the asset. In 2022 there were about 1.8 million Bitcoins left to mine.

No more Bitcoin will be mined after 2040 when a fixed total of 21 million will be in the market, a point that Bitcoin “maximalists” who believe this is the only solid investment in cryptocurrency often raise. Other currencies are run, not fully by software, but also by organization that can change the supply of coins issues, and much like a state government, causing the value of the coins to diminish. This “trustless” component, that is, a set of rules governing supply and method of mining rather than humans is one of Bitcoin’s core strengths as an international currency.

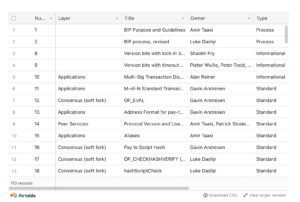

In fact, Bitcoin is not perfectly trustless, but just the closest thing. it does have a team of core developers entrusted with making key decision. Anyone can propose a Bitcoin Improvement Proposal (BIP) to the editor, who can approve it and submit it to a vote. There have been just more than a hundred of such proposals.

However, they need to meet a specific format, including the code that will be implemented, and have 95% of the support of the last 2016 Bitcoin miners in the last 14 days. Even then, the others in the community building using the Bitcoin protocol can choose to adopt the new soft fork. So this is a very conservative way to make a change in the protocol, so say the least.

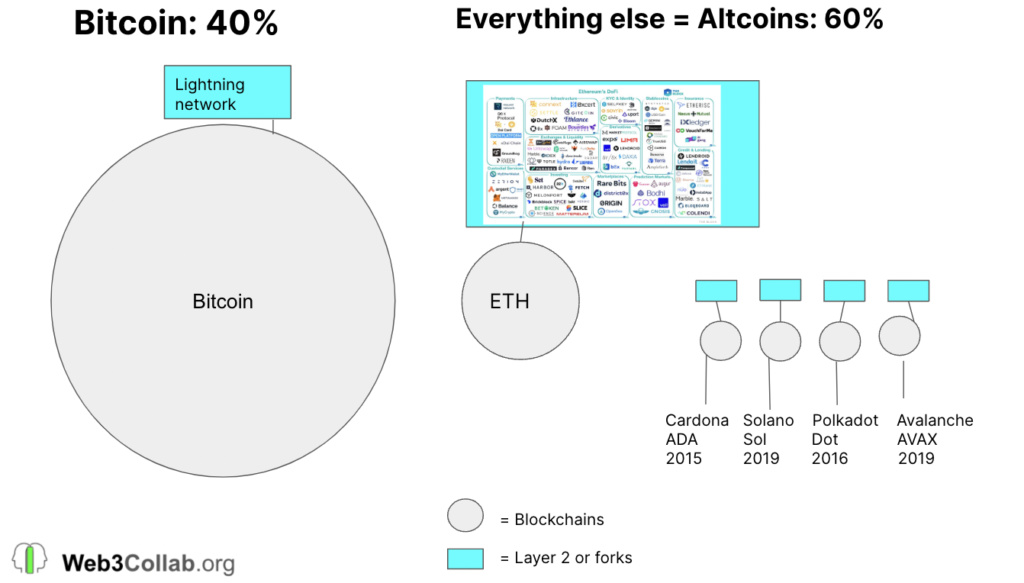

Any coins that are not Bitcoin, and are built on a different blockchain, are called altcoins.

The coin with the second-highest value is Ethereum, which provides a blockchain-based software platform that acts like the infrastructure of a city on which numerous other buildings and energy grids are built. New protocols for new coins have been built in layers on top of this base software. Ethereum also used a lighter, faster model of POW, which inspired numerous competing chains to use POS for faster, less expensive transactions. Ethereum successfully converted to Proof of Stake in September 2022.

Today, Bitcoin is seen as a store of value, while Ethereum’s value comes from the massive and ever-growing number of layer 2 organizations built on its blockchain and thus using its native coin.

To understand the competitors in the market today, it is helpful to look at a timeline of how the industry evolved:

1982 – Dissertation that data can be stored in Blocks. Cryptographer David Chaum proposes a blockchain-like protocol Instead of cells, Data can be stored in blocks using cryptology.

1991 – Blockchain is invented with the concept of timestamps. Stuart Habor and W. Scott Stornetta invent Blockchain: A typographically secured chain of data blocks, in which timestamps cannot be altered.

2008 – Bitcoin white paper published. Coder/s Satoshi Nakamoto, identity unknown, posts 9-page paper, “Bitcoin: A Peer-to-Peer Electronic Cash System” to a group of cryptographers. The search for a global digital currency, (which had actually been predicted and inserted as line 402 in the original internet protocol), is finally coming to an end.

2009 – Block 0 is released and the first 50 coins are awarded. Embedded in the block is the timestamp: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” showing how influential the financial meltdown was on Bitcoin’s creators.

2010 – S.N. walks away, gives control of the source code repository and network alert key to Gavin Andresen, who would go on to claim that Chris Williams was the real Satoshi Nakamoto, and be kicked off the Bitcoin core developer team.

2011 – The first BIP is submitted. Here is a record of these submissions:

2013 – Vitalik Buterin approaches the core team that is developing Bitcoin apps. Couch-surfing through Europe, the 18-year-old meet a group of 19 Bitcoin core developers working on colored coins. He suggests turning Bitcoin’s blockchain into a framework to host the second layer of numerous apps. They take a pass.

2014 – Vitalik and Partners announce the Ethereum project at the North American Bitcoin Conference in Miami, designed to be a blockchain anyone can develop an app on top of it. It is owned and crowd-funded by the Swiss non-profit Ethereum foundation.

2016 – Ethereum‘s launches The DAO, the first DAO, and the first ICO Ethereum’s own founders are astonished when they raise $150 million sale of ETH, avoiding SEC security regulations. However, the thrill is interrupted when $50 million vanishes due to an unknown hacker. ETh’s DAO group, Robinhood, has to steal the rest of the coins back to prevent further losses. Out of the ether, a biography of Helium chronicles the journey. After losing $8 million an hour, Ethereum Foundation creates a “hard fork” to erase the theft.

2015 – Ethereum co-founders begin peeling off to form other blockchains. Charles Hoskinson leaves to launch Cardano network, a private/public hybrid-owned company. Another founder moves on to Polkadot. Both have faster transaction times.

2017 – Cardano hits a market cap of $10 billion. Solana is formed, named after a beach town where co-founder Anatoly Yakavenko once lived in Southern Ca. Voyager, a centralized exchange & lending platform and Celsius, also a centralized lending platform are founded. OpenSea, soon to become the Amazon of NFT projects launches in December.

2018 – Lighting Network beta formed, aims to solve Bitcoin speed issues by providing off-chain wallet-to-wallet transactions.

2020 – NBA Top Shot NFT launches, modeled after baseball cards, bringing NFTs into the mainstream.

2021 – 16,000 altcoins are available on various blockchains, and growing. Anyone can launch tokens for $500 on Upwork, or a DAO on Aragon. Beeple NFT sells for $69 million. The Twitter founder sold his first Tweet as an NFT for $2.9 million in March. Bored Ape NFT launches in April. Trillions pour into cryptocurrencies from all over the world. The summer of 2021 is nicknamed, Crypto Summer. By August 2021, 18.7 million bitcoins have been already mined, leaving roughly 2.3 million to be mined by 2040. The Defi industry is in full swing, with centralized lending companies requiring investors to hold coins in their own native wallet to earn interest and rewards, rather than redepositing the coins in a decentralized wallet (see discussion of wallets in the upcoming module).

2022 – Crypto winter. Singapore-based Third Arrow crypto hedge fund defaults and bankrupts 4 more centralized lending entities that offered these staking opportunities to earn interests and rewards for holding certain coins in the native wallets. Celsius and Voyager, and file bankruptcy crashing the crypto markets. I

The sensational returns were created by inside teams reinvesting customer funds on even more volatile currency offerings. Since there are no regulations, such as required reserves, and no federal insurance on deposits except for Fiat dollars held, when the internal teams lending for higher rates made a mistake by lending to Third Arrow downstream; a run on the markets ensued. It is 1929 all over again in the crypto world. Buyers can’t unload Dorsey’s first Tweet for $21,000.

In the fall, FTX, founded by high-profile Sam Bankman-Fried also files for bankruptcy. This time the industry is in full shock; Bankman-Fried’s team had not just made an investment mistake, it had transferred customer funds to its co-owned, investment company Alameda Research, which created a conflict of interest. Even experienced institutional investors failed to identify the issue, in spite of the transparency promised by the Blockchain. A competitor, Binance.com, spotted the issue and dumped its holdings in the FTX token, sparking the sell-off.

2023: There are still more than 100 blockchains, including Bitcoin, with the top ten chains locked in fierce competition. Bitcoin still holds 40% of the monetary volume, with 60% in “everything else.” While the entire industry lost hundreds of billions, it was still altogether worth less than $1 trillion, so had no effect on the overall traditional stock markets and exchanges.

Visually, the marketplace still looks a little like this, with the blue boxes being second-layer organizations – from NFT marketplaces, Defi projects, and all types of DAOs, – all built on top of a variety of new blockchains.

Centralized versus decentralized exchanges

A note on vocabulary here: Each blockchain has its own native coin, used to pay the transaction fees, and these coins along with stable coins (coins tied to the US dollar) typically have the highest volume and price in the “top 25” coins list investors watch on realtime market trackers like Coinbase and TradingView. Everything else that is not a native coin is technically considered a token, although most people use “coins and tokens” interchangeably.

Competition between blockchains

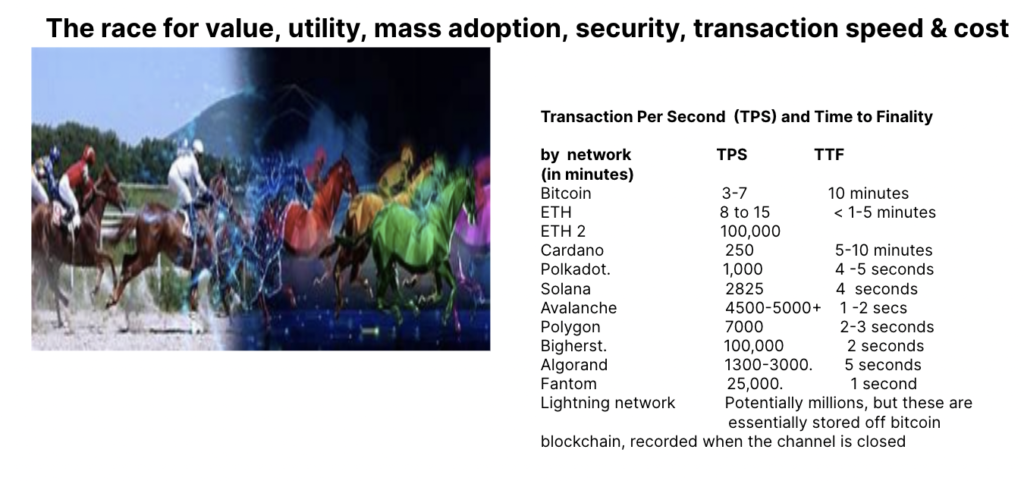

One competitive issue between blockchains is the transaction time, based on Transactions per Second (TPS) and Time to Finality (TTP). Faster transactions add not only convenience and price certainty but also lower transaction fees. ETH, for example, when using Proof of Work, could only process 3 to 7 transactions per second and took 10 minutes for each block to finalize, so depending on volume at the time, the transaction fees, called gas fees, could be $70 to $150. That sent many developers over to faster blockchains like Solana using proof of stake to process thousands of transactions a second and complete a new block in seconds. Ethereum launched ETH2, a lighter faster fork in September 2022, and is still the largest blockchain (volume, investment, number of developers, price of its native token) after Bitcoin, however, by then multiple blockchains had recruited their own ecosystem of developers, often “paying them” in grants to build on their own blockchains.

Bitcoin’s second layer, the Lightening Network, can process hundreds of thousands of transactions per second, by dividing the transactions into smaller groups that can be processed simultaneously.

Other blockchains, including Ethereum, Polkadot, and NEAR, have started using another technology, sharding, to link additional nodes and store greater information without significantly slowing down transaction time.

Other indicators underpinning value are the strength and number of companies built in the second layer. So far, Ethereum is far ahead of the other blockchains in this regard, but that can always chance.

Important differences between Centralized and Decentralized Exchanges

Just like stocks, coins are traded on exchanges. While some major coins are included in the stock – or equity-market apps like Robinhood, or else the largest cryptocurrency exchanges such as Coinbase and Binance.us, these are all centralized exchanges. They are owned by a company or central organization, which holds the coins and can freeze access in a pinch, the way a Wall Street exchange can stop trading, go bankrupt, as Voyager did in 2022, or become subject to hacks, as Binance was the same year. Their interfaces, however, tend to be easier to use and, typically a centralized exchange will require you to use their wallet, and they hold the private seed words. If you lose your password you can reset it. So there is a trade-off here between convenience and security. These exchanges may also offer staking opportunities, to encourage investors to leave their coins on the exchange, rather than transfer them to a more secure wallet.

Decentralized exchanges, on the other hand, are governed only by software protocols, not a central authority. They provide access to additional coins and greater versatility with thousands of coins. They do not hold your coins but only connect to your wallet. They are also more anonymous, and cannot be shut down by a central company in times when the market is volatile.

Best practice if you use a centralized exchange for convenience is to move your coins off and into a wallet in which the user holds their own private seed words, such as a hard wallet or Metamask.

Listen to the video below to see key differences.

In short, decentralized exchanges can be more difficult to use, but are easier to set up and have less risk.

Next, see the tools you will need to start using to evaluate investment opportunities.

Go to the next module: Tools to monitor the industry and blockchain pricing.